ChinaTravelNews, Ritesh Gupta - China demands a detailed study of mobile handsets and app stores whenever a travel brand attempts to design and develop or release a new version of a mobile app for this market.

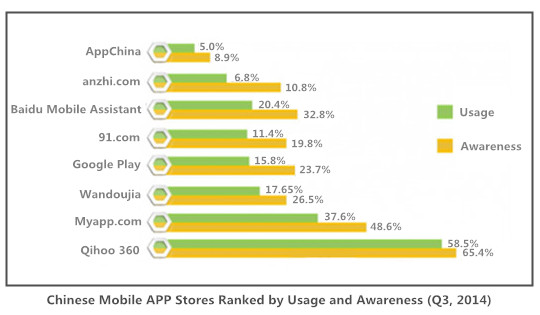

There are numerous app stores, over 100 of them, and focusing only on iTunes and Google Play isn’t enough. Leaders in this arena include Qihoo’s 360 Mobile Assistant, Tencent’s Myapp and Baidu Mobile Assistant.

(Data doesn’t feature iOS)

A thorough understanding is must considering the seamless experience that brands desire to offer today.

“Users are moving to mobile in China. At Ctrip.com, we provide seamless user experience to our users across traditional PC website, mobile apps and new device like Apple Watch. User can use the full functionality, regardless of PC website and mobile apps,” says Shanghai-based Haoran Chen, mobile engineering director at Ctrip.

Uniqueness

Dealing with peculiar features of handsets: Mobile engineering teams have to handle a deluge of mobile handsets. This means there is a need to handle “version diversion” when it comes to dealing with locally produced handsets. Talking of this, Chen says, Chinese vendors’ mobile handsets are mostly based on Android OS system. However they eliminate original Google services - App Market, Google Account, etc. and replace as their own version of these services. “Sometimes they also add features like the ones iOS system has. The result is version diversion.”

So how the team deals with this?

Chen says the team has to strengthen many development resources to make the company’s app compatible with different vendors’ Android and hardware systems.

“For iOS, the system is more consistent. Users can easily and are also more willing to upgrade to the latest version,” explains Chen.

As for a major player like Ctrip.com, the OTA, has amassed huge download numbers. Total mobile app downloads were 800m or so by the end of first quarter, an increase of over 550% from a year ago. Mobile channels accounted for around 70% of total online transactions in the first three months of 2015.

Promoting apps: Even in terms of traffic that is driven for adoption of mobile apps, Google doesn’t shape up the same as it does in other markets.

Gene Deng, VP, JD.com says: “The focus in China is primarily on driving traffic to mobile websites. Already there is an option to land on a specific page on an app if you are searching on the mobile website. So a user can reach to a desire page on an app, provided it’s downloaded.” .

He adds, “Companies can avail a couple of options to drive traffic to their mobile websites – a paid listing on hao123.com, which is essentially a mash-up of websites. An advertiser can list their website in a chosen category, and garner substantial traffic to their site. Plus, Baidu, is an option to target audience,” shared Deng, who added that when it comes to iOS the options are severely restricted. As for Android-based apps, there are several channels, which can be termed as Chinese versions of Google Play. The list of Android apps distribution channels include Qihoo 360, Wandoujia and 91, according to Deng.

So how are Chinese travel e-commerce players looking at popularizing the use of mobile apps?

“It is vital to create awareness about your brand. We do rely on mass channels like TV. But the objective is multi-fold – not just promote apps. There are other ways, for instance, bar code on our shopping bags. We do around two million bags a day as the leading e-commerce player in China,” says Deng, who added that mobile channel contributes around 45% of transactions. These transactions come via mobile website, mobile app and WeChat.

Of course, this strategy is a prudent way since travel sites have nothing to do with shopping bags as such, whereas jd.com can do so as it is an e-retailer! The company recently shared that its fulfilled orders in Q1 were 227.2 million, an increase of 76% from 129.3 million for the same period in 2014. Fulfilled orders placed through mobile accounted for approximately 42% of total orders fulfilled in the first quarter of 2015, a 329% increase compared to the same period in 2014.

As for overall marketing promotions, JD.com, too, is looking at apps. For instance, during the Chinese Spring festival JD.com distributed virtual “red envelops” – traditional Chinese gifts of money to consumers – around RMB100 million via Weixin and Mobile QQ, two mobile social applications in China, to promote brand awareness and enhance customer stickiness.

Among others, LY.com initiated an aggressive app promotion last year. Titled, RMB 1 Attraction Ticket, it encourages the users to download the mobile app to buy this RMB 1 ticket. This has driven the number of app downloaded to over 110 million in about six months, ranking them after Ctrip and Qunar. A source shared, “They (LY.conm) do not release how much budget was marked for this promotion, but only said part of the expenditure incurred is covered by its partners, including attractions, banks, other e-commerce sites.”

Adapting it at a local level

For foreign brands, it is essential to capitalize on local research, and engineering capabilities and then make the most of the company’s global asset.

Digital marketer and hospitality industry executive Hugh Xu, who has been associated with Hyatt in the past, says when the team works on a new app and coordinates with mobile engineering, the first task is to conduct research. It involves assessment of the expectation of a potential guest. Then the team prioritizes, evaluates what’s possible and reaches the demo stage of a prototype. It is tested with customers, with focus on look and feel of the app, and feedback is collated. Then prototype is refined further if needed, and one builds on the design and functionalities. As for the apps that are essentially part of global assets, the immediate focus is on localization. Then it comes to adaptation of functionalities. Lastly, the team works on “local made for local” aspect, which essentially refers to local set up or local assets conforming to the guidelines on which global assets are based on.

Chen highlights that different departments have different requirements. He admits that sometimes these requirements are in conflict. “For example, marketing are hoping to push more messages to the user, the product department will feel the same can have an (adverse) impact on the user experience. We need to make them to compromise with each other. Product department usually prefers more product features, however our team needs to make some technical improvements of the mobile app. This means we need to work proper schedule management,” says Chen.