ChinaTravelNews – China’s latest audit of its star-rated hotels shows that the industry achieved total revenues of RMB54.816 billion at average occupancy rate (AOR) of 58.31% in Q3 of 2014.

Some 12,611 of the 13,508 star-rated hotels (equivalent to 93.36%) in the China National Tourism Administration’s statistical management system completed the official auditing in Q3. Less the 884 hotels that ceased operations during the period, a total of 11,727 provided operational data for Q3 of 2014.

Overall outlook

Of the total revenue in Q3, RMB25.764 billion (47%) was generated from room sales and RMB22.162 billion (40.43%) was food and beverage incomes.

The average room rate (ARR) of star-rated hotels for the period was RMB324.40 per night and total revenue per available room (RevPar) was RMB189.16 per night. The total shared revenue per room was RMB34,407.29.

Regionally, the six cities with the highest ARR were Shanghai, Beijing, Hainan, Tianjin, Guangzhou and Tibet. The cities with the highest average occupancy rate were Tibet, Hunan, Shanghai, Guizhou, Beijing and Shandong. The top six regions for RevPar were Shanghai, Beijing, Tibet, Fujian, Hainan and Sichuan. The top six regions for average shared revenue were Shanghai, Bijing, Suzhou, Zhejiang, Fujian and Shandong.

Regional outlook

A total of 4,915 star-rated hotels (36.39% of total reviewed hotels) in 50 major touristic cities were audited in Q3 2014.

The top ten cities for average room rate and occupancy rate, arranged according to star-rating, are listed below.

Top 10 cities for hotel ARR in Q3 2014

Comparative data

Comparison by hotel star-rating

Below is a comparison of the year-over-year and quarter-over-quarter growth/drop of averages room rate, occupancy rate, revenue per room, and shared revenue of hotels in different star-rating.

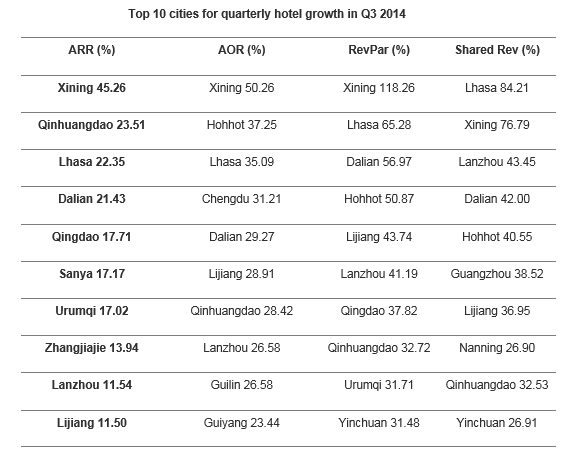

Below is a comparison of the top ten cities in quarter-over-quarter growth in the averages of room rate, occupancy rate, revenue per room and shared revenue.Comparison by city

Below is a comparison of ten cities with the biggest quarter-over-quarter decline in the averages of room rate, occupancy rate, revenue per room and shared revenue.

(Translation by David)