As another Northern Hemisphere Winter Season draws to a close, this week’s headline flight data is slightly down on recent weeks. As a result of significant Covid-19 capacity cuts in China due to Covid-19 outbreaks, global airline capacity has settled back to 80.8 million seats and there are significant movements in global positioning- more on that later. However with the arrival of the Summer Season, capacity is going to increase significantly.

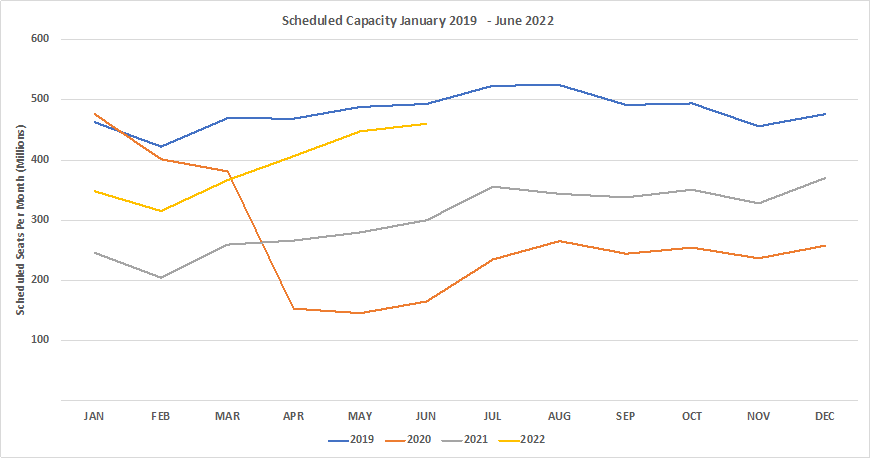

In the below chart we have added the latest airline capacity for June 2022 which currently stands at some 460 million which is just 7% below the 2019 mark, although it will inevitably settle back a bit from that number as airlines refine their schedules in the coming months subject to demand. And although fuel prices continue to be an issue it seems that pent up demand remains strong with more and more travel bookings made every day suggesting that the Summer will be strong for most carriers around the globe.

Chart 1 - Weekly Capacity Changes by Region, Forward Quarter

Source: OAG

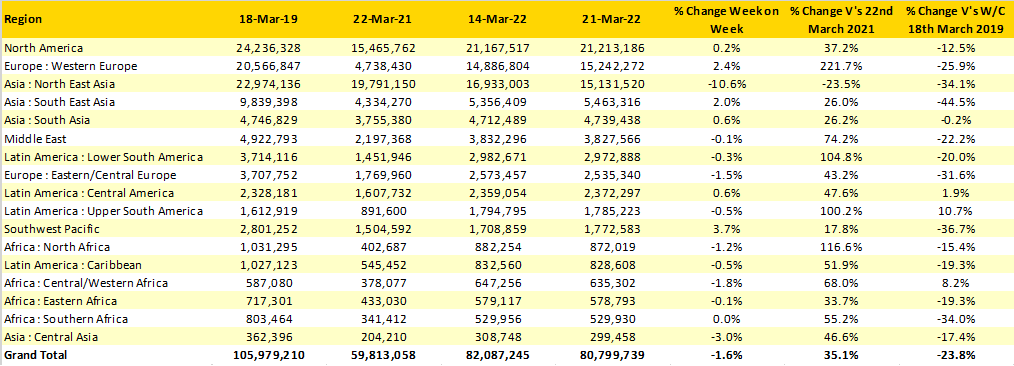

Western Europe is now the second largest regional market in the world as a combination of 2.4% growth in the region and a 10.6% reduction in North East Asia sees the two swap places. Western Europe continues to recover and with 15.1 million seats this week now has some 10.5 million more seats available than at this point last year although the region is still 25% below its pre-Covid-19 levels.

The variable nature of the pandemic and its impact on regional markets can once again be seen in some of the data points. Three regions, Upper South America (+11%), West Africa (+8%) and Central America (+2%) are now reporting more capacity than was available in 2019 and are clearly moving forward; at the same time despite the relaxation of travel restrictions the Southwest Pacific remains at 37% below the same week three years ago and Southern Africa similarly at -34%.

Table 1 – Scheduled Airline Capacity by Region

Source: OAG

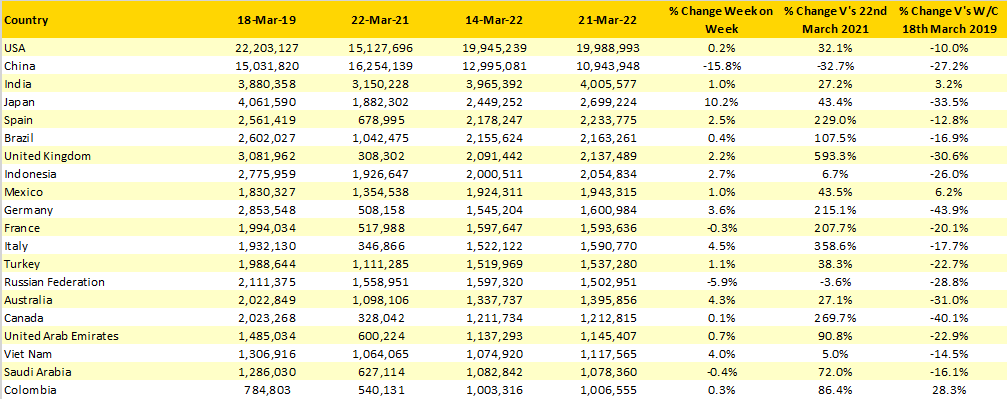

With over two million fewer seats this week than last, China is one of the few country markets to be reporting capacity reductions versus the same week last year with a near one-third reduction in capacity. Airline capacity across the Chinese domestic market has been turned on and off like a tap throughout the pandemic and the latest round of lockdowns will probably impact capacity for the next few weeks at least with major cities such as Shenzhen beginning to slowly ease their restrictions.

Table 2 - Scheduled Capacity, Top 20 Country Markets

Source: OAG

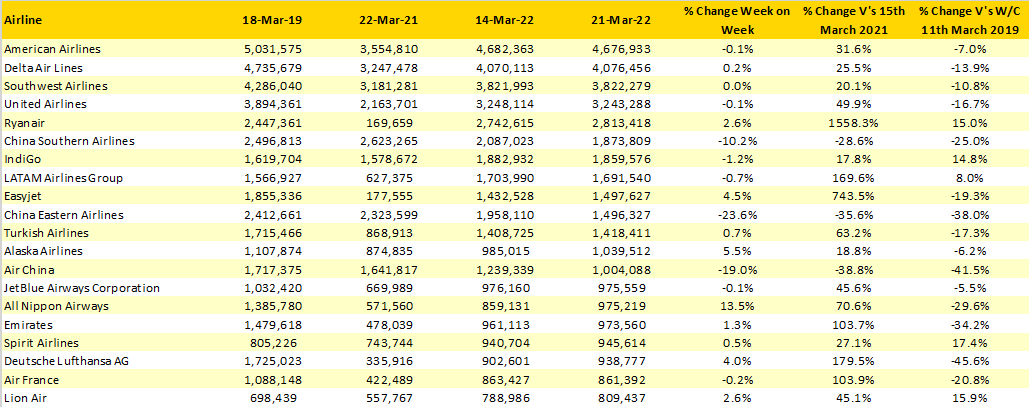

Not surprisingly all the major Chinese carriers have been impacted by the latest restrictions on travel across the country although by varying degrees. China Eastern have been the most badly impacted with a 24% reduction in capacity with the airline falling three places but just staying within the global top ten. In a solid fifth position in the table are Ryanair who as always deal in remarkable numbers, their year on year capacity growth is a quirk, but to go from just 170,000 seats a week last year and ramp up to 2.8 million so quickly is an impressive result.

Table 3 – Top 20 Capacity Declines W/C 14th Mar’22 V’s 11th Mar’19

Source: OAG