Trip.com Group reported that its business has showed resilient recovery in the China domestic market.

Compared with the same period pre-COVID in 2019, both domestic hotel and air ticketing reservations have fully recovered since early March 2021 and achieved double-digit growth for the month.

Revenues from corporate travel management grew 101% year-over-year and 6% compared with the same period in 2019.

"Trip.com Group's mission is to pursue the perfect trip for a better world. Over the past two decades, we have continuously been exploring and innovating to further expand our offerings," said James Liang, Executive Chairman. "Going forward, we will continue to expand product offerings, improve service quality, innovate our content, and bring new value to the travel industry."

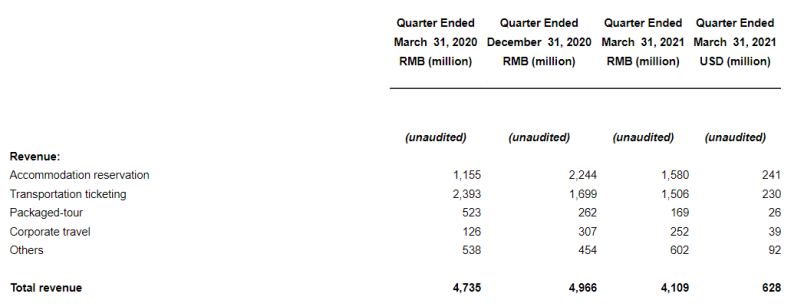

For the first quarter of 2021, Trip.com Group reported net revenue of RMB 4.1 billion (US$ 628 million), representing a 13% decrease from the same period in 2020, mainly due to a strong recovery in March 2021, partially offset by the decrease in cross-border travel. Net revenue for the first quarter of 2021 decreased by 17% from the previous quarter.

Accommodation reservation revenue for the first quarter of 2021 was RMB 1.6 billion (US$ 241 million), representing a 37% increase from the same period in 2020, primarily due to the strong demand for inter-provincial stays. Accommodation reservation revenue for the first quarter of 2021 decreased by 30% from the previous quarter, primarily due to the travel restrictions introduced in January and February of 2021.

Transportation ticketing revenue for the first quarter of 2021 was RMB1.5 billion (US$230 million), representing a 37% decrease from the same period in 2020, and an 11% decrease from the previous quarter, primarily due to the travel restrictions introduced in January and February of 2021.

Packaged-tour revenue for the first quarter of 2021 was RMB169 million (US$26 million), representing a 68% decrease from the same period in 2020, and a 35% decrease from the previous quarter.

Corporate travel revenue for the first quarter of 2021 was RMB252 million (US$39 million), representing a 101% increase from the same period in 2020. Corporate travel revenue for the first quarter of 2021 decreased by 18% from the previous quarter.

Net income attributable to Trip.com Group's shareholders for the first quarter of 2021 was RMB 1.8 billion (US$ 273 million), compared to net loss attributable to Trip.com Group's shareholders of RMB 5.4 billion in the same period in 2020 and net income attributable to Trip.com Group's shareholders of RMB 1.0 billion in the previous quarter.

Sales and marketing expenses for the first quarter of 2021 decreased by 31% to RMB952 million (US$145 million) from the same period in 2020 and decreased by 23% from the previous quarter, primarily due to the decrease in expenses relating to sales and marketing promotion activities. Sales and marketing expenses for the first quarter of 2021 accounted for 23% of the net revenue.

As of March 31, 2021, the balance of cash and cash equivalents, restricted cash, short-term investment, held to maturity time deposit and financial products was RMB 66.1 billion (US$ 10.1 billion).