ChinaTravelNews, Ritesh Gupta – Chinese retailers, e-commerce specialists and others are showing signs of bouncing back. Astute companies are looking at buying and consumption pattern on an ongoing basis to shape up their respective selling strategies.

A prime example being certain e-commerce players looking at geographical features of China and evaluating night-time activities. It has been identified by Meituan that the ratio of night-time consumption is related to the geographic latitude of cities. And cities with lower latitude generally have a higher proportion of night-time consumption. Meituan chose to go for a cluster analysis, featuring 119 cities in the third-tier and above.

Mckinsey China also focused on a detailed study, featuring over 100 million points-of-sale data on buying behavior before, during, and after the COVID-19 crisis. All of this makes for a fascinating study and insight into novel buying patterns.

Looking at the overall purchase loop

There are couple of aspects that stand out – how much to save and spend, and how to go about spending.

Online grocery shopping or food deliveries at an attractive price have emerged as activities that consumers are indulging on a regular basis across the globe. According to McKinsey, 55 percent of Chinese consumers are likely to continue buying more groceries online after the peak of the crisis.

Even as travel brands have been hit hard with consumers cutting down on trips, they need to find ways to get into this overall spending loop.

Jackey Yu, Associate Partner, McKinsey & Company Hong Kong

Highlighting a couple of aspects in this context, Jackey Yu, Associate Partner, McKinsey & Company Hong Kong said, “Many (Chinese) hotels shifted (their focus) to food delivery service during the crisis, and this can be a good field to enter for reliable and credible brands. E.g., hotel restaurants have a good reputation of (serving) good quality food. We can imagine innovative new business model or services as a diversified revenue stream. Question is how agile travel brands can allow such creativity within their (respective) organizations, (paving way for such) operational viable ideas and pilots.” Chinese hotel brands embraced the situation and turnaround quickly to get into consumers’ daily or frequent activity cycle. For example, hotel chain BTG’s F&B and hotel-related products are being sold on several channels such as their official website, OTA package offerings and coupons on WeChat Mini Program. The chain also offers takeaway food on third-party food delivery platforms.

Mckinsey also highlighted that Chinese consumers are now putting even more thought into how they manage their personal finances. So how can airlines and travel brands associate themselves with fintech or personal finance specialists to propel their recovery plans? Also, the study indicated that four out of five Chinese consumers intend to purchase more insurance products post-crisis. More than 70 percent of respondents in the COVID-19 consumer survey will continue to spend more time and money purchasing safe and eco-friendly products. “…we do see rise of personal financial products related to protection and flexibility of traveling, e.g., travel insurance or health insurance can be a good add-on to travel products. In China, travel insurance penetration, for example, is lower than other mature markets,” said Yu.

Taking cue from travel shoppers in China

China has been in news for border-reopening projects with other countries. But way before this, as witnessed in the second and third quarters, of utmost significance is to assess the confidence of the travelers, before delving into boosting domestic tourism activities and then if possible outbound-related initiatives/ product offerings. Yu says don’t count on the entire audience as one.

He referred to a couple of aspects:

* Gear up for different customer segments: “Craft product (offerings) and promotion for different segments in stages,” he said. Citing the approach witnessed in China he said the “young single” segment came back first (April-May), followed by the family segment (during the summer season), post this the others such as the “elderly” segment (National holiday).

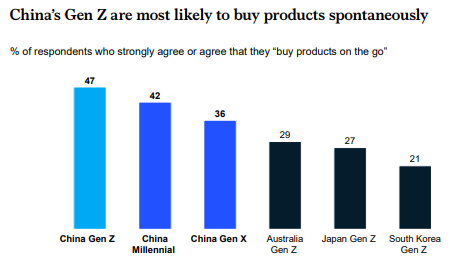

Referring to a demographic, McKinsey said Gen Z (born between 1996 and 2010) represent the next engine of domestic consumption growth. China’s Gen Z is the most spontaneous of all, with 47 percent sharing that that they buy products on the go. This audience describes itself as “the moonlight clan” in reference to propensity to spend their entire monthly salary over the course of a single lunar cycle, effectively living paycheck to paycheck.

Source: McKinsey study

Referring to this generation, Yu said, “Personalization is key, Gen Z in China loves personalization and customization. Surprisingly, Gen Z has a higher loyalty to brands they like. And with effective personalization and loyalty-related initiatives, one can focus on “the value proposition of product and brand, and stick with Gen Z segment”, said Yu. “What to avoid? Gen Z is a big segment, don’t treat them the same, it’s key to understand the micro segments and tailor offerings accordingly,” he said.

* Product strategy: Yu said some new product types emerged out from the crisis, e.g., RV (recreation vehicle) trip (such vehicles feature living quarters designed for accommodation), outdoor adventurous sports such as skiing etc. There are quite many new destinations for these. Especially the nearby rural areas closer to tier-one cities. He referred to Fengxian/Jinshan district of Shanghai, Qiandao Lake in Hangzhou, Kunshan in Suzhou and Huairou district of Beijing.

Also, Chinese travelers have shown penchant for self-guided tours or road trips within the country. “Self-guided tours were not uncommon before the crisis, but its share is increased due to the fear of travelling with strangers, so people prefer more to travel with direct family or friends. Therefore, how to craft the product to tailor these specific needs would be critical. Safety and hygiene is still the core concern, while have unique experience to relax and try new things, esp. on outdoor, health, nature related themes would be more preferred. Connectivity with families is key, esp. after being locked down for a while in the year,” said Yu.

* Digital marketing: Yu said digital marketing effectiveness is “not only about deploying (a certain) marketing budget to new channels or media, but more importantly the management of a new channel (or existing ones) to tie with business objectives, e.g., traffic generation, member reawakening (action from inactive loyalty program members), sale conversion etc.” Existing channels are being used in a novel way, for instance, revenue generation via live streaming featuring CEOs or new customer acquisition channels such as finance-related apps as unconventional touchpoints for customer acquisition.

One marketer also referred to the significance of capitalizing on feelings or emotions that have been suppressed for months now. “People are missing travel,” said Martyn U'ren, Head of Research - APAC and MENA, Twitter, during an online presentation at the recently 2020TravelDaily Conference. Going viral is being linked with “missing out on travel” or “planning a trip soon” or a real trip being undertaken in China. Travel brands have been looking at capitalizing on FOMO (fear-of-missing-out) element tends to trigger a viral effect on social media such as Weibo, RED, and Douyin (China’s Tiktok). Klook has observed that surfing has gone viral and has become a new desirable weekend activity for Millennials and Gen-Z in Shenzhen.

Digital for selling alone not enough

Engage your customers digitally end-to-end. “We believe the value in doing digital is not only about selling, but really addressing customer pain points along the customer journey from pre-trip, in-trip and post trip,” said Yu. Evaluating the approach of one premium apparel retailer, McKinsey found that this company has worked on number of initiatives, including sales professionals to use WeChat groups to reach out to VIP customers with individualized products (supported by a CRM system), launching social media shows with Key Opinion Leaders (KOLs), and ramping up content marketing. The bottom line is that companies must engage the entire organization to prepare for an omnichannel world. This requires a digital network architecture, backed by a dedicated operational set up, KPIs, and objectives and key results (OKR) frameworks that can help the organization define goals and track outcomes, according to the study.

Health and safety

Travel brands can’t ignore the importance of what consumers want from a brand when it comes to their health and keep the environment clean. All of this can be incorporated while approaching a travel shopper.

As witnessed in case of grocery retailers in China, they are highlighting safe ingredients in the fresh and packaged foods. One way to do so is by meeting this expectation by directly purchasing food from farms. Similarly in case of travel, feeling safe and secured will no doubt take a new spin. Companies in travel, too, would find ways to ensure they get to the bottom of what all can be a threat to the health of passengers/guests and how the same is being tackled.