Tongcheng-Elong Holdings, a Chinese online travel firm co-invested by Trip.com Group and Tencent, today announced the audited consolidated results for the three and six months ended June 30, 2020, together with comparative figures for the same periods of 2019.

Key Highlights

The Company’s operation and performance were inevitably disrupted by the COVID-19 outbreak since January 2020. Compared with the same periods in 2019, some key metrics for the three and six months ended June 30, 2020 declined due to the decreased demands in travel business.

However, compared with the remarkable decrease in the previous quarter, the company sees a recovery trend in the second quarter of 2020 for some key metrics, which was attributable to the restoration of economic activities and living orders in mainland China since the outbreak of COVID-19 being contained.

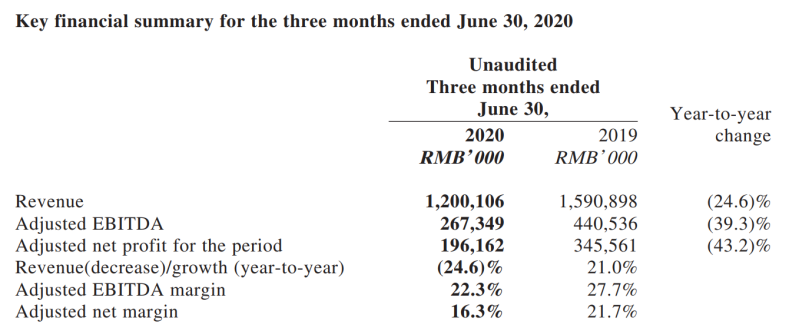

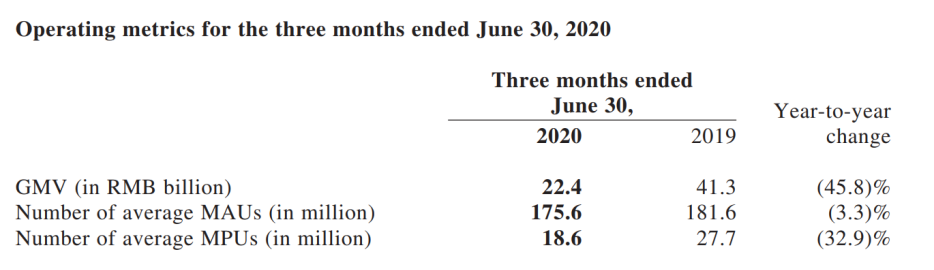

For the three months ended June 30, 2020:

• Revenue decreased by 24.6% year-to-year to RMB1,200.1 million from RMB1,590.9 million in the same period of 2019. Such decrease was narrowed down compared with 43.6% decline in the first quarter of 2020. Also, on a quarter-to-quarter basis, the revenue in the second quarter of 2020 increased by 19.4%.

• Adjusted EBITDA dropped from RMB440.5 million in the second quarter of 2019 to RMB267.3 million in the same period of 2020. The year-to-year decrease was narrowed down to 39.3% in the second quarter of 2020 from 74.2% in the first quarter of 2020. In the second quarter of 2020, adjusted EBITDA margin decreased from 27.7% in the second quarter of 2019, or increased from 15.8% in the previous quarter, to 22.3%.

• Adjusted net profit for the period dropped from RMB345.6 million in the second quarter of 2019 to RMB196.2 million in the same period of 2020. The year-to-year decrease was narrowed down to 43.2% in the second quarter of 2020 from 82.6% in the previous quarter.

• Average MAUs decreased by 3.3% year-to-year from 181.6 million in the same period of 2019 but increased by 18.3% quarter-to-quarter from 148.4 million in the first quarter of 2020 to 175.6 million.

• Average MPUs decreased by 32.9% year-to-year from 27.7 million in the same period of 2019 but increased by 25.7% quarter-to-quarter from 14.8 million in the first quarter of 2020 to 18.6 million.

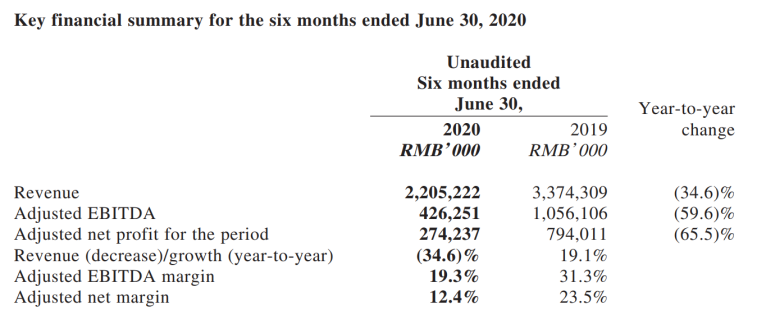

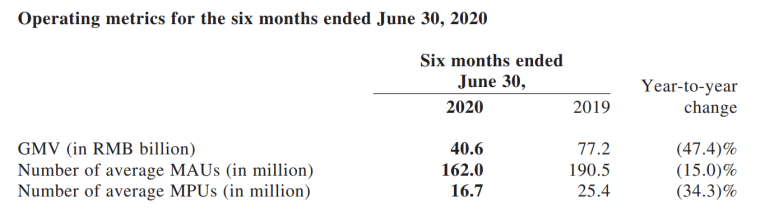

For the six months ended June 30, 2020:

• Revenue decreased by 34.6% year-to-year to RMB2,205.2 million from RMB3,374.3 million in the same period of 2019.

• Adjusted EBITDA decreased by 59.6% year-to-year to RMB426.3 million from RMB1,056.1 million in the same period of 2019. Adjusted EBITDA margin decreased from 31.3% in the same period of 2019 to 19.3%.

• Adjusted net profit for the period decreased by 65.5% year-to-year to RMB274.2 million from RMB794.0 million in the same period of 2019. Adjusted net margin decreased from 23.5% in the same period of 2019 to 12.4%.

• Average MAUs decreased by 15.0% year-to-year from 190.5 million in the same period of 2019 to 162.0 million.

• Average MPUs decreased by 34.3% year-to-year from 25.4 million in the same period of 2019 to 16.7 million.

Business review

In the depths of the pandemic, Tongcheng-Elong focused on protecting its users and supporting suppliers by implementing various kinds of initiatives. It opened up a self-service online cancellation function on its platforms for users to fast-track refund and changes. It also launched a “Safe Room” initiative to ensure a safe environment for hotel guests. To help its suppliers, it established an Ark Alliance to form allies and promote tourist spots via online marketing for free.

To capture the revitalization of the travel industry, it also launched “Hit The Road” initiative to explore innovative marketing channels such as live streaming programs to enhance brand awareness and promote interactions with users.

It extended its reach in lower-tier cities in China and captured the recovery and growth opportunities in these cities. As of June 30, 2020, the percentage of its registered users resided in non-first-tier cities in China maintained at approximately 85.9%. For the three months ended June 30, 2020, approximately 63.1% of its new paying users on Weixin platform were from tier-3 or below cities in China, which increased from 61.5% in the same period of 2019.

As of June 30, 2020, its online platforms offered over 7,500 domestic routes operated by about 750 domestic airlines and agencies, over 2 million hotels and alternative accommodation options, nearly 370,000 bus routes, 590 ferry routes and approximately 8,000 domestic tourist attractions ticketing services.

In the second quarter of 2020, it launched a new brand name “同程旅行” (“ly.com”) and a new brand logo, as well as a new slogan “Together, let’s go!”. By upgrading the brand, it reinforced its young and modern brand image and further emphasized on targeted customers.

Business outlook and strategies

Based on the currently available information, for the third quarter of 2020, the company expects revenue to decrease by approximately 5.0% to 10.0% year-to-year, and adjusted net profit for the period to be in the range of RMB300.0 million to RMB400.0 million.

In terms of long-term development, Tongcheng-Elong believes the ongoing development and further investment in infrastructure in China will continue to provide immense growth potentials to the travel industry.

The company says it will further penetrate into the travel market in China, especially in lower-tier cities, by leveraging on its diversified and cost-effective traffic sources.

Re-designation of CMO to COO

The Board announces that with effect from August 28, 2020, Mr. Wang has been re-designated to Chief Operating Officer of the Company from the post of Chief Marketing Officer due to internal adjustment of personnel responsibilities of the Company, its subsidiaries and consolidated affiliated entities. Mr. Wang will be responsible for the operations management of the Group.

Read original article