Trip.com Group Limited, a leading provider of online travel and related services, including accommodation reservation, transportation ticketing, packaged tours and in-destination services, corporate travel management, and other travel-related services, today announced its unaudited financial results for the fourth quarter and full year ended December 31, 2019.

Key Highlights for the Fourth Quarter and Full Year of 2019

• Income from operations for the fourth quarter of 2019 was RMB580 million (US$84 million), compared to the loss of RMB189 million in the same period in 2018. Excluding share-based compensation charges, non-GAAP income from operations increased by 294% year-over-year to RMB1.0 billion (US$148 million) in the fourth quarter of 2019.

• Net income attributable to Trip.com Group's shareholders reached RMB2.0 billion (US$289 million) in the fourth quarter of 2019, resulting in 2019 full year net income of RMB7.0 billion (US$1.0 billion), compared to net loss of RMB1.2 billion in same period in 2018 and net income of RMB1.1 billion for full year 2018.

• The year-over-year revenue growth for hotels (excluding Greater China destinations) reached 51% in the fourth quarter of 2019.

• Brand Trip.com delivered its 13th consecutive triple-digit growth for international air ticketing volume in the fourth quarter of 2019.

• The Company meaningfully increased the presence in lower-tier cities.

• Ctrip branded low-star hotel room-nights increased by around 50% year-over-year in the fourth quarter of 2019.

• By the end of 2019, the offline stores reached close to 8,000 in operation and in the pipeline.

"We achieved strong results in the fourth quarter, despite facing macro challenges in certain regions," said Jane Sun, Chief Executive Officer. "The team delivered solid execution, driving both topline growth and bottom-line profitability. Our business fundamentals have never been healthier than today, with both international expansion and lower-tier city penetration becoming increasingly important drivers in our future growth roadmap."

"Despite a challenging beginning in 2020, we are confident of the underlying fundamentals of the Chinese economy, and continue to feel excited about the opportunities globally as well", said James Liang, Executive Chairman. "During the recent novel coronavirus outbreak, we took immediate actions to take care of our customers and partners, while taking on necessary financial impact in the near term. We firmly believe it was the right thing to do for us as the industry leader, and look forward to coming back even stronger after the outbreak is contained. Looking beyond the temporary slowdown, we continue to strive to become the best travel companion for a global and growing customer base in the many years to come."

Fourth Quarter and Full Year of 2019 Financial Results and Business Updates

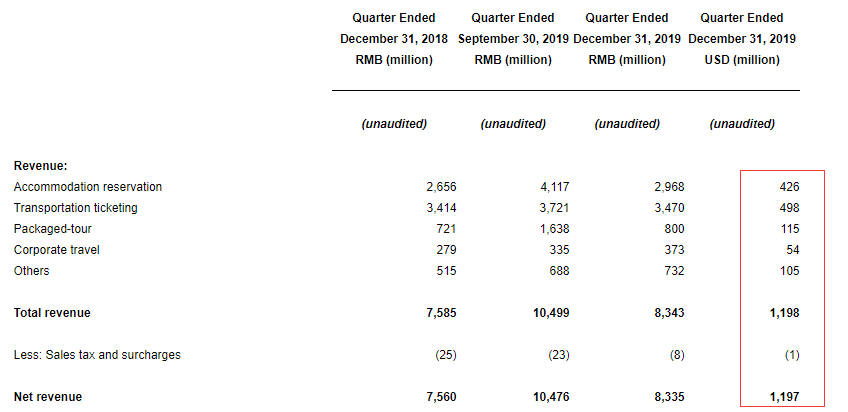

For the fourth quarter of 2019, Trip.com Group reported net revenue of RMB8.3 billion (US$1.2 billion), representing a 10% increase from the same period in 2018. Net revenue for the fourth quarter of 2019 decreased by 20% from the previous quarter, primarily due to seasonality.

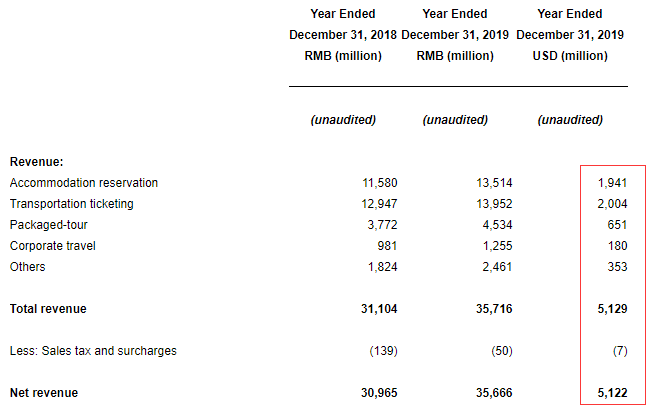

For the full year ended December 31, 2019, net revenue was RMB35.7 billion (US$5.1 billion), representing a 15% increase from 2018.

Accommodation reservation revenue for the fourth quarter of 2019 was RMB3.0 billion (US$426 million), representing a 12% increase from the same period in 2018, primarily due to the brand's extensive global reach, expansion in the global product portfolio, and provision of diversified accommodation choices to prospective customers. Accommodation reservation revenue for the fourth quarter of 2019 decreased by 28% from the previous quarter, primarily due to seasonality.

For the full year ended December 31, 2019, accommodation reservation revenue was RMB13.5 billion (US$1.9 billion), representing a 17% increase from 2018. The accommodation reservation revenue accounted for 38% of the total revenue in 2019 and 37% of the total revenue in 2018.

Transportation ticketing revenue for the fourth quarter of 2019 was RMB3.5 billion (US$498 million), representing a 2% increase from the same period in 2018. Transportation ticketing revenue decreased by 7% from the previous quarter, primarily due to seasonality.

For the full year ended December 31, 2019, transportation ticketing revenue was RMB14.0 billion (US$2.0 billion), representing an 8% increase from 2018. The transportation ticketing revenue accounted for 39% of the total revenue in 2019 and 42% of the total revenue in 2018.

Packaged tour revenue for the fourth quarter of 2019 was RMB800 million (US$115 million), representing an 11% increase from the same period in 2018, primarily driven by an increase of organized tours and self-guided tours. Packaged tour revenue for the fourth quarter of 2019 decreased by 51% from the previous quarter, primarily due to seasonality.

For the full year ended December 31, 2019, packaged tour revenue was RMB4.5 billion (US$651 million), representing a 20% increase from 2018. The packaged tour revenue accounted for 13% of the total revenue in 2019 and 12% of the total revenue in 2018.

Corporate travel revenue for the fourth quarter of 2019 was RMB373 million (US$54 million), representing a 33% increase from the same period in 2018, primarily driven by expansion in travel product coverage and corporate customer base. Corporate travel revenue for the fourth quarter of 2019 increased by 11% from the previous quarter.

For the full year ended December 31, 2019, corporate travel revenue was RMB1.3 billion (US$180 million), representing a 28% increase from 2018. The corporate travel revenue accounted for 4% of the total revenue in 2019 and 3% of the total revenue in 2018.

Gross margin was 79% for the fourth quarter of 2019, remained consistent with that for the same period in 2018 and the previous quarter.

For the full year ended December 31, 2019, gross margin was 79%, compared to 80% in 2018.

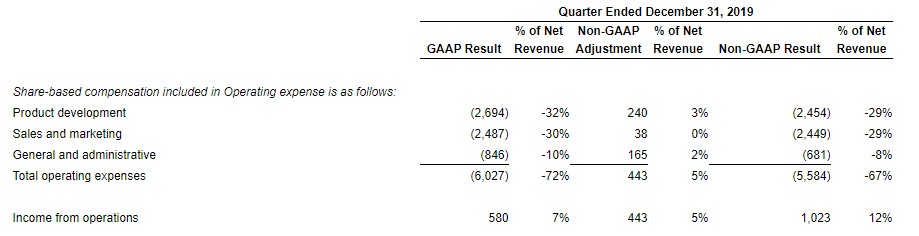

Product development expenses for the fourth quarter of 2019 decreased by 1% to RMB2.7 billion (US$387 million) from the same period in 2018 and decreased by 3% from the previous quarter. Product development expenses for the fourth quarter of 2019 accounted for 32% of the net revenue. Excluding share-based compensation charges, non-GAAP product development expenses for the fourth quarter of 2019 accounted for 29% of the net revenue, which decreased from 33% for the same period of 2018 and increased from 25% for the previous quarter.

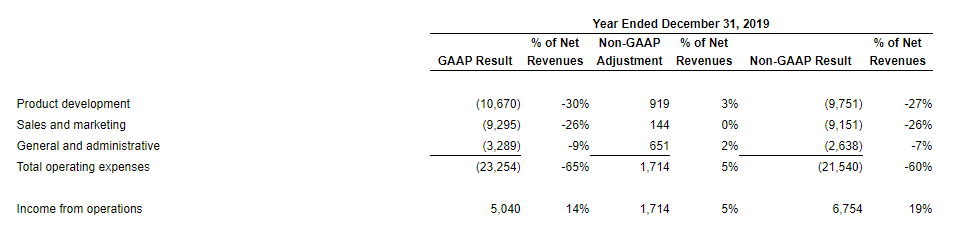

For the full year ended December 31, 2019, product development expenses increased by 11% to RMB10.7 billion (US$1.5 billion) from 2018 and accounted for 30% of the net revenue. Excluding share-based compensation charges, non-GAAP product development expenses accounted for 27% of the net revenue, which decreased from 28% in 2018.

Sales and marketing expenses for the fourth quarter of 2019 decreased by 5% to RMB2.5 billion (US$357 million) from the same period in 2018, primarily due to the decrease of sales and marketing related activities. Sales and marketing expenses remained consistent with those for the previous quarter. Sales and marketing expenses for the fourth quarter of 2019 accounted for 30% of the net revenue. Excluding share-based compensation charges, non-GAAP sales and marketing expenses for the fourth quarter of 2019 accounted for 29% of the net revenue, which decreased from 34% in the same period in 2018 and increased from 23% in the previous quarter.

For the full year ended December 31, 2019, sales and marketing expenses decreased by 3% to RMB9.3 billion (US$1.3 billion) from 2018 and accounted for 26% of the net revenue. Excluding share-based compensation charges, non-GAAP sales and marketing expenses accounted for 26% of the net revenue, which decreased from 30% in 2018.

General and administrative expenses for the fourth quarter of 2019 increased by 5% to RMB846 million (US$121 million) from the same period in 2018 and increased 5% from the previous quarter, primarily due to an increase in general and administrative personnel-related expenses. General and administrative expenses for the fourth quarter of 2019 accounted for 10% of the net revenue. Excluding share-based compensation charges, non-GAAP general and administrative expenses accounted for 8% of the net revenue, which remained consistent with those for the same period in 2018 and increased from 6% for the previous quarter.

For the full year ended December 31, 2019, general and administrative expenses increased by 17% to RMB3.3 billion (US$472 million) from 2018 and accounted for 9% of the net revenue. Excluding share-based compensation charges, non-GAAP general and administrative expenses accounted for 7% of the net revenue, which remained consistent with 2018.

Income from operations for the fourth quarter of 2019 was RMB580 million (US$84 million), compared to the loss of RMB189 million in the same period in 2018 and the income of RMB2.2 billion in the previous quarter. Excluding share-based compensation charges, non-GAAP income from operations was RMB1.0 billion (US$148 million), compared to RMB261 million in the same period in 2018 and RMB2.6 billion in the previous quarter.

For the full year ended December 31, 2019, income from operations was RMB5.0 billion (US$723 million), compared to RMB2.6 billion in 2018. Excluding share-based compensation charges, non-GAAP income from operations was RMB6.8 billion (US$970 million), compared to RMB4.3 billion in 2018.

Business Outlook

The beginning of 2020 was challenging for travel industry due to the outbreak of the novel coronavirus. As a result of the impact of the coronavirus outbreak, the company has lowered the expectations for growth in the first quarter of 2020. For the first quarter of 2020, the Company expects net revenue to decrease by approximately 45% to 50% year-over-year. This forecast reflects the current and preliminary view based on best information available at the time, which is subject to change.

During the conference call, Ms. Jane Sun, CEO of Trip.com Group, said that the company expects accommodation revenue to decrease about 60% to 65% year-on-year. Packaged tour business is projected to drop about 50% to 60% year-over-year with corporate travel business to decrease about 50% to 60% year-over-year.

Read Original Report