Ctrip's annual report on Form 20-F includes its audited consolidated financial statements for the years ended December 31, 2016, 2017 and 2018.

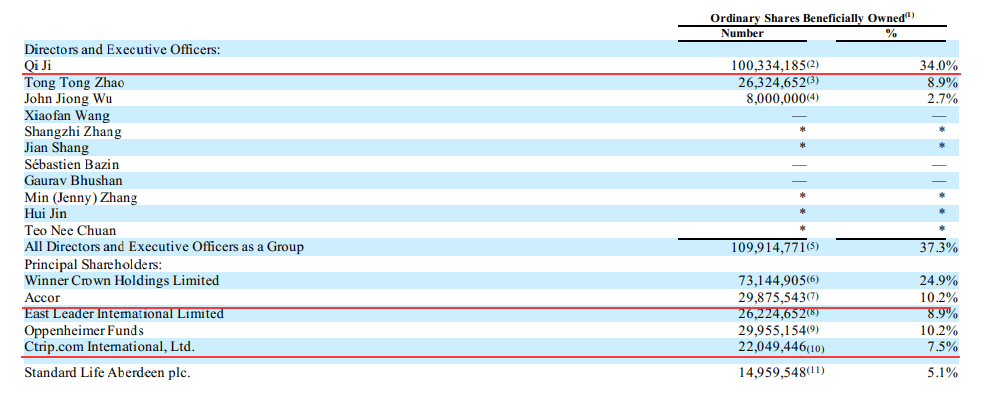

Share Ownership

The following table sets forth information with respect to the beneficial ownership, as of March 31, 2019 by:

• each of Huazhu’s directors and executive officers; and

• each person known to us to own beneficially more than 5% of Huazhu’s ordinary shares.

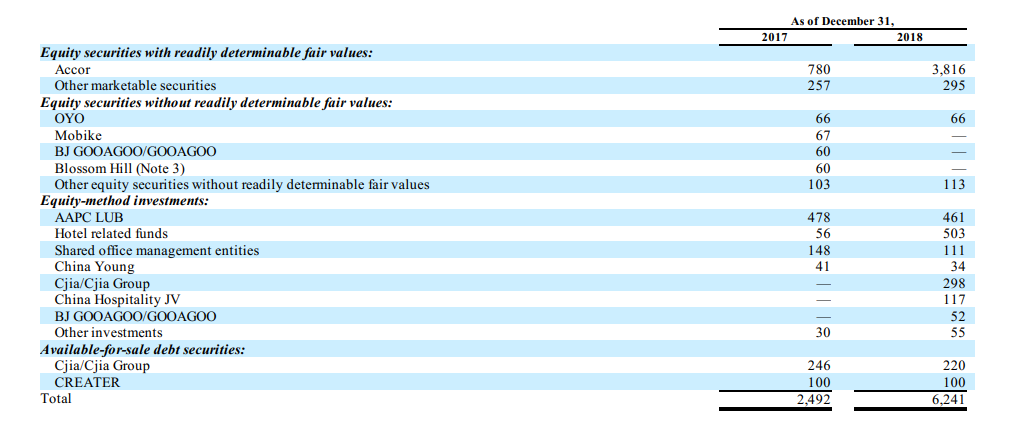

The investments as of December 31, 2017 and 2018 were as follows:

In 2017 and 2018, the Group purchased 2,309,981 and 10,782,131 ordinary shares of Accor, a hotel group listed in Paris stock exchange, from open market. As of December 31, 2018, the Group accumulatively hold 13,092,112 shares of Accor, which accounts for less than 5% of Accor’ total outstanding shares where the Group does not have the ability to significantly influence the operations of this entity. In 2018, along with the adoption of ASU 2016-01, the Group recognized unrealized losses from fair value changes of Accor of RMB794.

At December 31, 2017 and December 31, 2018, the Group had RMB257 and RMB295, respectively, of other marketable securities, which represent investments in entities in hospitality or related industries where the Group do not have the ability to significantly influence the operations of these entities. In 2018, the Group recognized unrealized losses from fair value changes of other marketable securities of RMB120.

In September 2017, the Group purchased approximately 1% equity interest of Oravel Stays Private limited (“OYO”), an India leading hospitality company. The Group accounted the investment as equity securities without readily determinable fair values since the Group does not have the ability to exert significant influence over OYO.

Huazhu entered into a share subscription agreement in September 2017 with Oravel Stays Private Ltd. (“OYO”), where Huazhu agreed to make a US$10 million equity investment in OYO to become a minority shareholder (less than 5%).

In January 2017, the Group purchased 1,316,205 preferred shares and invested in convertible notes with principal amount of US$5.0 million and interest rate of 8% of Mobike Ltd. (“Mobike”), a Chinese bike-sharing company. As of December 31, 2017, the Group had less than 1% equity interest of Mobike. The Group accounted the investment at cost method prior to 2018. Along with the adoption of ASC 2016-01, the Group accounted it as equity securities without readily determinable fair values. In 2018, the Group disposed all the Mobike preferred shares and recognized a gain of RMB55.

In 2018, the Group partnered with an unrelated third party investor to form China Hospitality JV, Ltd. (“China Hospitality JV”), of which the Group holds 20% equity interest. The business of China Hospitality JV was to acquire and operate two hotel properties. As of December 31, 2018, the Group had approximately 20% equity interest of China Hospitality JV. The Group accounted for the investment in China Hospitality JV under equity-method as the Group has the ability to exert significant influence. The Group recognized investment loss of RMB11 in income (loss) from equity method investments in 2018.

In September 2017, the Group invested in Shanghai CREATER Industrial Co., Ltd. (“CREATER”), a staged office space company in China, for two-year convertible notes amounted RMB100 with an interest rate of 10% per year. The convertible notes with equity pledge are convertible upon satisfaction of certain conditions or at the option of the Group to ordinary shares in the last month before the expiration. The convertible notes are recorded as available-for-sale debt securities.

Brand and Properties

As of the date of this annual report, the Group owns 12 hotel brands that are designed to target distinct segments of customers

Huazhu has also entered into brand franchise agreements with Accor and enjoyed exclusive franchise rights in respect of “Mercure”, “Ibis” and “Ibis Styles” in the PRC, Taiwan and Mongolia and non-exclusive franchise rights in respect of “Grand Mercure” and “Novotel” in the PRC, Taiwan and Mongolia:

As a result of Huazhu’s customer-oriented approach, the Group has developed strong brand recognition and a loyal customer base. In 2018, approximately 76% of Huazhu’s room nights were sold to individual and corporate members of HUAZHU Rewards, Huazhu’s loyalty program.

Huazhu had 10,507, 13,525 and 15,699 employees as of December 31, 2016, 2017 and 2018, respectively. The Group recruits and directly trains and manages all employees.

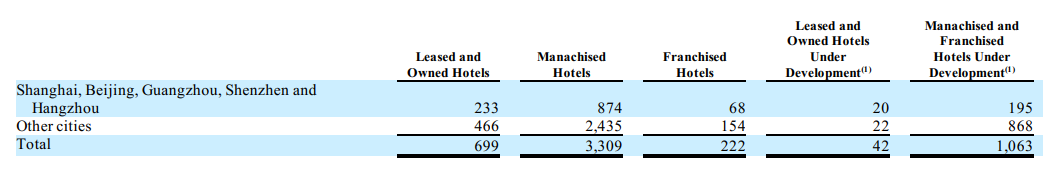

As of December 31, 2018, Huazhu operated 4,230 hotels in China. Huazhu has adopted a disciplined return-driven development model aimed at achieving high growth and profitability. As of December 31, 2018, Huazhu’s hotel network covered 403 cities in 32 provinces and municipalities across China. As of December 31, 2018, Huazhu had an additional 1,105 leased and owned, manachised and franchised hotels under development.

The following table sets forth a summary of all of Huazhu’s hotels as of December 31, 2018.

Sales and Marketing

Huazhu’s marketing strategy is designed to enhance the brand recognition and customer loyalty. Building and differentiating the brand image of each of Huazhu’s hotel products is critical to increasing brand recognition. Huazhu focuses on targeting the distinct guest segments that each of Huazhu’s hotel products serves and adopting effective marketing measures based on thorough analysis and application of data and analytics. In 2018, approximately 86% of Huazhu’s room nights were sold through Huazhu’s own sales platforms and the remaining 14% of Huazhu’s room nights through intermediaries.

Competition

The lodging industry in China is highly fragmented. A significant majority of the room supply has come from stand-alone hotels, guest houses and other lodging facilities. In recent years hotel groups emerged and began to consolidate the market by converting standalone hotels into members of their hotel groups. As a multi-brand hotel group, Huazhu believes that they compete primarily based on location, room rates, brand recognition, quality of accommodations, geographic coverage, service quality, range of services, guest amenities and convenience of the central reservation system. Huazhu primarily competes with other hotel groups as well as various stand-alone lodging facilities in each of the markets in which Huazhu operates. Huazhu’s HanTing Hotels, Orange Hotels, Ibis Hotels and Elan Hotels mainly compete with Home Inns, Jinjiang Inn, 7 Days Inn, various regional hotel groups and stand-alone hotels, and certain international brands such as Super 8 and OYO hotels.

HanTing Hotels, Orange Hotels and Ibis Hotels also compete with two- and three-star hotels, as they offer rooms with amenities comparable to many of those hotels. Huazhu’s JI Hotels, Starway Hotels, Orange Hotels Select, HanTing Premium Hotels, Ibis Styles Hotels, Mercure Hotels and Novotel Hotels face competition from existing three-star and certain fHuazhu’s-star hotels, boutique hotels whose price could be comparable and a few hotel chains such as Vienna Hotels, AtHuazhu’s Hotels, Hampton Hotels and Holiday Inn Express. Huazhu’s Hi Inns compete mainly with stand-alone guest houses, low-price hotels and budget hotel chains such as Pod Inns, 99 Inns and 100 Inns. Huazhu’s Joya Hotels, Manxin Hotels and Grand Mercure Hotels compete with existing fHuazhu’s-star and five-star hotels. Huazhu’s Manxin Hotels, Crystal Orange hotels and Blossom Hill Hotels also compete with boutique resort hotels.