Ctrip announced on April 26 the 2.0 version of its tailored travel platform, which was initially launched in January 2016. The new platform has more than 1,200 suppliers and around 4,000 recommended travel specialists, covering 956 destinations in 107 countries worldwide.

It handles over 80,000 trip-customizing orders with total transaction value of more than RMB 100 million each month, according to Ctrip.

A travel preference survey conducted by Ctrip last month showed that 10% of the respondents intend to try customized trips. The survey randomly sampled more than 2,000 Ctrip users in over 20 Chinese cities out of the OTA’s total 250 million registered members.

The platform for tailored travel takes commission from partner suppliers but does not charge a service fee. The company’s backend products such as flight tickets, hotel offerings, visa and insurance services are also available to partner suppliers.

The platform currently has 40% of its orders from overseas markets and the remainder 60% from the domestic market.

Zhiyun Xu, general manager of Ctrip’s tailored travel unit, projected that the unit will grow its revenue to around RMB 10 billion in two years and has 120,000 monthly orders. The middle-class consumers traveling with kids are considered the biggest source group in the tailored travel market.

Other than Ctrip, established travel companies like Tuniu, Tongcheng Tourism, CYTS Tours and Utour also have their own tailored travel operation.

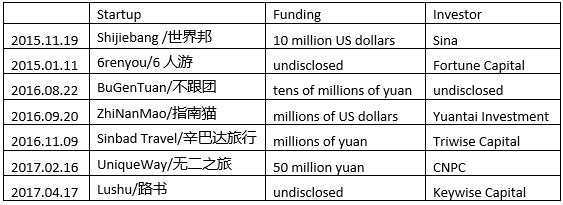

A lot of Chinese startups has entered into the tour-customizing sector in recent years, encouraged by a series of funding rounds from investors:

Further reports by ChinaTravelNews on the funding rounds of China’s tailored travel startups are as follows:

Sina adds US$10 million investment in Shijiebang

Travel app 6renyou raises new financing round from Fortune Capital

Tailored-tour startup BuGenTuan closes A round

Itinerary designer ZhiNanMao raises millions of dollars in A round

Sinbad Travel receives millions of yuan in A+ round