Hotel and travel consulting firm Horwath HTL China recently released a report following a survey gauging the recovery of China’s hotel industry and hoteliers’ outlook for the first quarter of 2021. The survey was the fourth in the series conducted by the company.

Occupancy

The outlook for China’s hotel industry was more positive in the second half of 2020 compared to the first half, since the COVID outbreak was largely under control. On the expectation of how the average occupancy rate in Q1 of 2021 would recover compared to the 2019 level, about 32% of thought it would recover to the same level of 2019, 12% expected it would surpass the 2019 level, while more than 50% believed the occupancy rate would still lag far behind, according to the report.

ADR

The expectation on average daily rate (ADR) recovery was however relatively gloomier. Over 60% of the respondents believed the first-quarter ADR would be lower than the level of Q1 2019. Hoteliers in China’s eastern, northeastern and northwestern regions were particularly pessimistic due to the resurgence of Covid-19 cases.

Revenue

About 67% of the respondents expected revenue for the first quarter to be lower than that of the same period in 2020, 20% expected it would be on par with Q1 2020, while only 13% thought there would be a year-on-year increase in revenue.

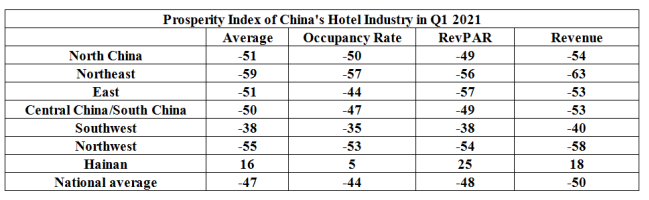

With winter traditionally a peak season for Hainan, the respondents in the popular southern Chinese tourist destination remained bullish about their performance in the first quarter. This made Hainan the only region to see a positive prosperity index in the survey.

On the contrary, the outlook for Q1 was more pessimistic in northern China where new Covid-19 cases have been reported.

Lower confidence index in first-tier cities

All first-tier cities Beijing, Shanghai, Guangzhou and Shenzhen showed weak market confidence for the first quarter of 2021, with their prosperity indexes ranging from -73 to -50, below the national average of -47.

Among the four cities, Shanghai has the lowest prosperity indexes – -69 for occupancy rate and -77 for ADR. Shanghai had the highest number of new hotels in recent years, but revenue growth was sluggish. The pandemic has intensified competition and thus lowered the city’s prosperity indexes.

Sanya remained a bright spot , with prosperity index for Q1 performance hitting a positive 24. But the index value is 50% lower than that of the score of 51 in the last quarter, due to the resurgence of Covid cases regionally and tightened quarantine regulations.

Mixed expectations for tier-2 cities

Chengdu & Chongqing

Buoyed by robust leisure travel demand for China’s southwestern destinations, the prosperity index for hotels in this region nudged closest to Sanya in the second half of 2020. But the slow winter season for most tourist destinations led to weakening confidence for Q1 in cities like Chengdu and Chongqing.

Nanjing, Hangzhou and Suzhou

The prosperity index scores for Nanjing, Hangzhou and Suzhou – all core cities of the Yangtze Delta region – went in different directions. With a growing base of business travelers, Nanjing saw more positive signs in occupancy rate and recorded a more favorable index score of -28.

Hoteliers in Hangzhou were also optimistic about the recovery of occupancy rate but they were still concerned about the ADR.

The prosperity index for Suzhou was lowering as it relies heavily on international business travelers.

Xi’an

Xi’an, in China’s northwestern region, was still reserved about Q1 performance as it faced stricter quarantine regulations while entering an off-peak season .

Wuhan

Although the prosperity index for Wuhan remained low, it has been improving in each quarter, indicating that this city is recovering from the devastating crisis.

Covid’s impact on hotel performance expected to continue

Given the changing pandemic situation, most respondents were expecting a prolonged impact of Covid-19. Only 7% of the respondents believed that the industry would recover within three months, and nearly 60% of the respondents expected the impact to last even longer, for at least seven months to over one year.

Among hoteliers in different regions in China, those in northwestern and northeastern regions as well as Hainan were more optimistic about recovery. Nearly 50% of the respondents believed that the impact of Covid-19 would dissipate within six months. However, respondents in other regions, particularly in northeastern region, were relatively pessimistic, with over 40% of hoteliers expecting the impact to last longer than 12 months

Most hoteliers believed that the recovery of national economy and tourism as well as the support of the central government were crucial to the full recovery of the hotel industry, and that domestic travel demand would continue to be the strongest driving force.